Request a Demo

Please fill out the contact form below and we will get back to you shortly

InTone.ai Risk is a set of simple and easy to use software tools and processes, based on Nemesysco’s proprietary Layered Voice Analysis technology (LVA™), designed to detect and measure changes in the evaluated party’s emotional reactions.

A multilevel centralized fraud prevention system providing dedicated interfaces to each user in your organization.

Contact center agents are not required to become professional investigators - Agent’s training is as simple as “follow these on-screen instructions…”.

Capture and screen through ALL telephone calls right where they start, at the contact center level.

A multilevel centralized fraud prevention system providing dedicated interfaces to each user in your organization.

Make impartial decisions based on repeating, verifiable and precise information.

InTone.ai Risk system is designed to streamline and expedite any risk analysis process by providing (where applicable) different system interfaces and tools for your contact center agents, underwriters, claims adjusters, investigators and managers.

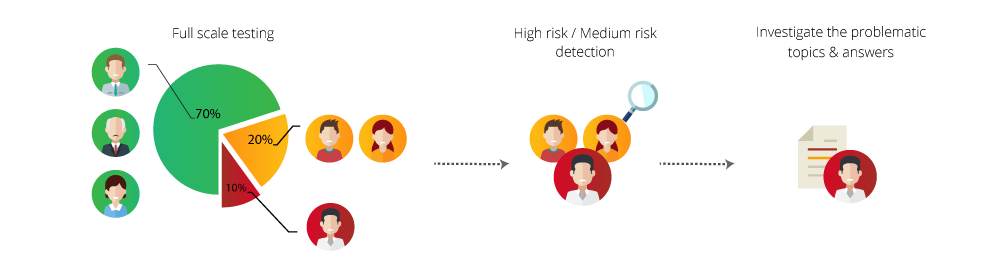

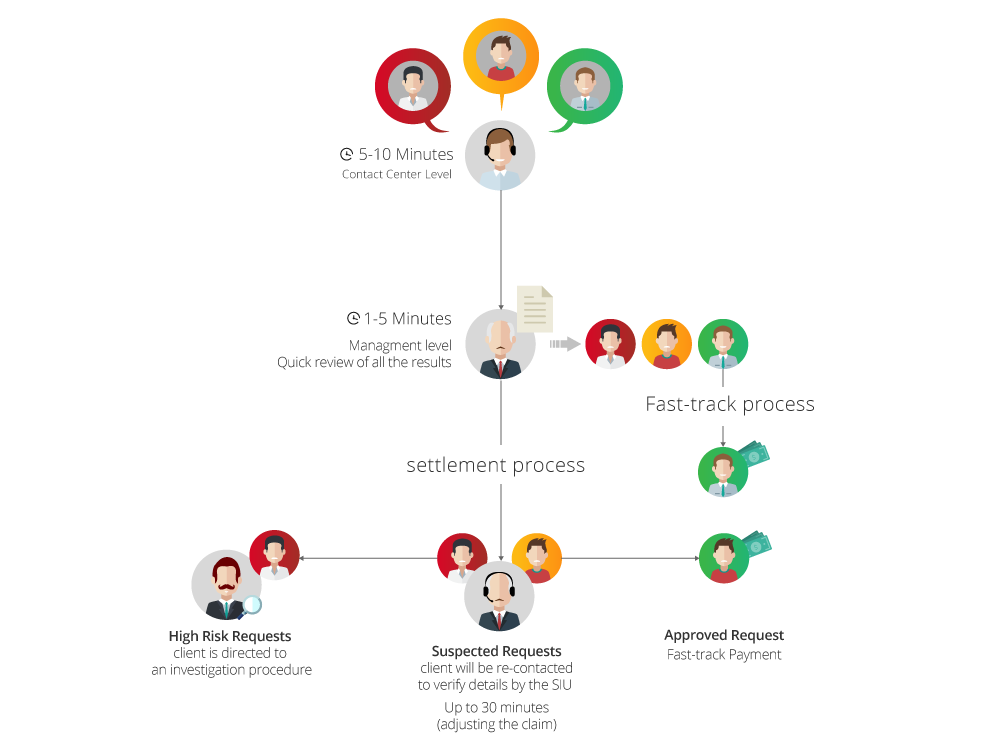

The contact center level tools will guide the agent through proper interview scripts designed to cross check and validate different relevant topics. Once the call has ended, a full analysis is automatically performed on the recorded call and the Risk Report is generated.

The Claims Manager/Underwriter screens will easily point to the irregular cases, highlighting the topics that are worthy of further investigation.

Any case NOT identified as irregular (meaning, Low Risk cases) can be forwarded to the Fast Track process. Medium Risk cases, in which most likely the base story is true, but some of the details are inaccurate, can often be settled with a follow-up call over the phone.

If a case is determined to be High Risk it will undergo a third review by professional investigators in the InTone.ai Risk system. Investigators’ interface displays precise analysis for each voice segment, identifying the exact topics to be clarified. In most cases, a direct phone call for clarification or a short field visit can reveal relevant information that will determine the actual case status and the fraud it contains.

Initial screening, providing automated first level indication for professional review.

Conduct risk assessment and screening in order to identify in advance high risk policies.

Perform "Know Your Customer" procedures in a structured and a most informative manner.

Verify the intentions and true financial capabilities of your applicant.

Identify cases where a change of circumstances occurred.

Nemesysco Ltd

2 Ha’ofe St., POB 5059

Kadima Industrial Park, Kadima, Israel

Postal Code: 6092000

Tel: +972-9-9605894

(English-International call)

Fax: +972-9-8853782

Please fill out the contact form below and we will get back to you shortly

Please fill out the contact form below and we will get back to you shortly

Please fill out the contact form below and we will get back to you shortly

Please fill out the contact form below and we will get back to you shortly

Please fill out the contact form below and we will get back to you shortly

Please fill out the contact form below and we will get back to you shortly